FINANCIAL MARKETS WEEKLY

Currency Diversification via a US Dollar mutual fund: Legacy USD Bond Fund - Minimum now 1,000 units

November 23, 2023

In normal and volatile times, it is always important to maintain an investment portfolio that is diversified across currencies. We normally recommend that at least 20% of an investor’s portfolio should be in foreign currency. An investor’s objective could be to hedge against a potential devaluation of the Naira or earn real returns on investments, given limited high-yielding local currency investment options. The Legacy USD Bond Fund (LUBF) can assist investors in achieving both goals. The LUBF is a mutual fund registered with the Securities and Exchange Commission, Nigeria. The Fund’s primary objective is to generate stable income over the long term. With a minimum of US$1,318.20, investors will gain exposure to Sovereign and Corporate US Dollar Eurobonds issued by the Nigerian government and Nigerian corporates. Also, once an investment has been made, the investor can monitor the value of the investment by clicking here. Please see Product Focus below for further details.

Inflation and the health care sector

Inflation numbers from the National Bureau of Statistics for October showed the composite consumer price index for health grew significantly, up 23.32% y/y. compared with 17.44% y/y in October 2022. Nigeria’s inflation has been on the rise and while the impact of rising food and utility costs on headline inflation has been extensively discussed, the surging costs of drugs and healthcare services has been overlooked. There has been a consistent and significant rise in the cost of pharmaceutical products, medical services, dental services, paramedical services, and hospital services since the covid -19 pandemic.

Health services in Nigeria are provided by both the public and private sectors. The public sector provides primary, secondary, and tertiary care while the private sector is mainly involved in primary and secondary care. For several years, the Nigerian health care sector has been facing several challenges and is currently both underfunded and understaffed. This is due to a number of factors, including the country's large population and low GDP per capita worsened by the recent Japa syndrome. As a result, many Nigerians do not have access to basic healthcare. The government’s intervention through the Basic Health Care Provision Fund (BHCPF) and the National Health Insurance Scheme (NHIS) has done little to improve access to healthcare.

The scarcity of foreign exchange and the continuous depreciation of the Naira is having an adverse effect on the nation’s health care system. Many pharmaceuticals and medical equipment are imported, and their prices are therefore affected by fluctuations in the exchange rate. This has made many drugs unaffordable for the masses. More so, the cost of research and development of pharmaceuticals has increased significantly making production very expensive. Besides the FX debacle, the rising cost of fuel and energy prices are also contributing to the rise in the cost of pharmaceuticals and healthcare services. Considering the essential nature of health care products and services, the government needs to find effective ways to intervene urgently.

- FX: Last week, the Naira traded at ₦840.04US$ from ₦805.00US$ in the interbank market.

- Bonds: In the secondary market for Federal Government of Nigeria (FGN) bonds, yields increased across most maturities. The yield on the 3-year FGN bond remained unchanged closing at 15.16%, and that on the 30-year FGN bond increased by 112 basis points to 16.91%. Indicative yields on US Dollar Eurobonds issued by Nigerian entities were between 8.39% and 15.01%, depending on maturity.

- Oil:The price of Brent increased by 1.67%, from the previous week’s closing price of US$80.61bbl to US$81.96bbl.

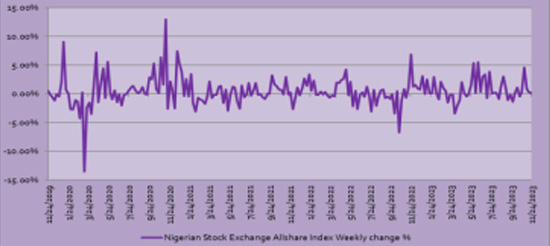

- Equities: Last week, the NGX All-Share Index gained 0.37%. The November 2023 YTD return was 38.75%. The Consumer Goods sector gained 0.24%, on average. UACN gained 12.50%, and CADBURY lost 4.17%. For the Brewers, NB gained 5.26%. The Industrial Goods sector lost 1.18%, on average. BUACEMENT lost 2.80. The NGX Banking sector lost 0.04%, on average ZENITH BANK gained 3.64% and FIDELITY lost 3.83%. In the Agriculture sector, OKOMU gained 1.35%.and PRESCO lost 2.53%.

FCMB Asset Management Products and Services

We offer a range of products and services to our clients. These include:

- Mutual Funds

- Legacy Money Market Fund (Minimum is N1,000. Rated A+ by Agusto & Co)

- Legacy Debt Fund Rated AA- & FV3 by Agusto & Co

- Legacy Equity Fund(Winner)*

- Legacy USD Bond Fund (Winner)* (Diversify. Invest as little as US$1,208.20)

- Portfolio Management (NGN and Foreign currency)

Including for International Index Tracker Funds and stocks listed on the London Stock Exchange-

These are:

- Discretionary Mandate

- Non-discretionary Mandate

- Execution-only Mandate

- Structured Products (NGN & Foreign currency)

- Portfolio Audit

-

These are:

* BusinessDay Banking Awards 2017; NSE CEO Award 2018

Product Focus: LEGACY USD BOND FUND

Do you have concerns about a potential weakening of the Naira? If yes, then you should consider converting part of your Naira into US Dollars and investing in the

Legacy USD Bond Fund. The Legacy USD Bond Fund is a Securities & Exchange Commission, Nigeria (SEC) registered US Dollar mutual fund. It is structured as a high-

yield mutual fund that seeks to generate stable income over the long term. The Fund invests in credit-rated US dollar-denominated fixed-income securities issued by

sovereigns and corporate entities.

Legacy USD Bond Fund is listed on the Nigeria Stock Exchange. The Fund has no currency risk since all investments are received and made in US Dollars.

The minimum number of units an investor can purchase is 1,000, and then in multiples

of 1,000. The offer price per unit as of Thursday, 30th of November 2023, is US$ 1.3194

cents. Therefore, an investor will need US$1,319.40 to purchase the minimum

investment units. The minimum investment period is 6 months.

Benefits include:

- Skilled and professional fund management

- Opportunity for capital appreciation and stable income

- Excellent means of hedging against potential Naira depreciation

- Convenient way of saving towards medium-to-long term goals, including towards future foreign currency related expenditure

- Unit holders will receive monthly Investment reports

Please click here, for more information on the Fund

| Mutual Funds (October 2023) | Net Return | *Gross Return |

|---|---|---|

| Legacy Money Market Fund (90-day average) | 8.26% | 9.18% |

| Legacy Equity Fund (monthly return) | -0.25% | N/A |

| Legacy USD Bond Fund (annualised return) | 4.39% | 4.88% |

*Yields/returns on mutual fund investments are not subject to withholding tax

| Recommended Stocks | Sector | Current Price # | 1 year target price # | Expected Change % |

|---|---|---|---|---|

| ETI | Financials | 16.00 | 23.23 | 45.19% |

| ZENITHBANK | Financials | 33.40 | 42.90 | 28.44% |

| NESTLE | Consumer Goods | 1050.00 | 1369.71 | 30.45% |

| WAPCO | Industrial Goods | 29.50 | 38.62 | 30.92% |

NGX ASI Weekly change % Since 2019

AS AT END OF OCTOBER 2023

| Country | 3-Month T-bill % | 3-year Govt Bond yield % | Headline CPI % |

|---|---|---|---|

| Nigeria | 6.2697 | 13.7430 | 26.72 |

| Kenya | 15.1110 | 17.7350 | 6.80 |

| South Africa | 8.2630 | 9.0855 | 5.40 |

| Brazil | 11.9171 | 11.2210 | 5.19 |

| Russia | 13.0964 | 13.6100 | 6.00 |

| India | 6.8900 | 7.3350 | 5.02 |

| China | 2.2700 | 2.4220 | 0.00 |

| USA | 5.4597 | 4.9000 | 3.70 |

| Germany | 3.7250 | 2.7890 | 4.50 |

| UK | 5.3780 | 4.5560 | 6.70 |

| Japan | -0.1996 | 0.2000 | 3.00 |

USD and EUR Denominated Bonds

| USD Eurobonds (Minimum 200,000 units) | Yields |

|---|---|

| Nigerian Government 7.625% Nov 2025 | 8.39% |

| Nigerian Government 6.50% Nov 2027 | 9.94% |

| Nigerian Government 6.125% Sep 2028 | 10.05% |

| Nigerian Government 8.375% Mar 2029 | 10.36% |

| Nigerian Government 7.143% Feb 2030 | 10.38% |

| Nigerian Government 8.747% Jan 2031 | 10.70% |

| Nigerian Government 7.875% Feb 2032 | 10.73% |

| Nigerian Government 7.375% Sep 2033 | 10.81% |

| Nigerian Government 7.696% Feb 2038 | 11.12% |

| Nigerian Government 7.625% Nov 2047 | 10.85% |

| Nigerian Government 9.248% Jan 2049 | 11.31% |

| Nigerian Government 8.25% Sep 2051 | 11.09% |

| Ecobank 9.5% April 2024 | 10.06% |

| Ecobank 9.5% Feb 2026 | 12.12% |

| Ecobank 8.75% June 2031 | 11.28% |

| FBNNL 8.625% Oct 2025 | 9.49% |

| Seplat 7.75% April 2026 | 11.74% |

| Access Bank 6.125% Sep 2026 | 11.49% |

| Access Bank 9.125% Perpetual Call October 2026 | 15.01% |

| Fidelity Bank 7.625% October 2026 11.33% | 11.33% |

| UBA 6.75% November 2026 | 10.76% |

| EUR Eurobonds (Minimum 100,000 units) | Yields |

| Bank of Industry 7.5% February 2027 | 11.14% |

| Offshore Index Tracker Funds | Minimum |

| US Equity MSCI Index Tracker Fund | US$5,000.00 |

AS AT END OF OCTOBER 2023

| Equity Index | Closing Price | Change % in Month (LCY) | Change % Year-to-date (LCY) | Change % Year-to-date (USD) | P/E ratio |

|---|---|---|---|---|---|

| Emerging Markets | 909 | -3.18 | -0.94 | 13.36 | |

| Developed Markets | 735 | -3.26 | 7.74 | 17.64 | |

| Nigeria | 69236 | 4.30 | 35.09 | -8.02 | 10.42 |

| Ghana | 3126 | -1.47 | 27.89 | 13.33 | 6.50 |

| Kenya | 89 | -6.99 | -30.52 | -48.69 | 4.83 |

| South Africa | 69653 | -3.77 | -4.65 | -13.81 | 10.96 |

| Brazil | 113373 | -2.74 | 3.32 | 7.95 | 7.54 |

| Russia | 3201 | 2.16 | 48.60 | 48.60 | 2.67 |

| India | 63875 | -2.97 | 4.99 | 4.36 | 22.60 |

| Hong Kong | 17112 | -3.91 | -13.49 | -13.77 | 9.49 |

| USA | 4167 | -2.83 | 8.52 | 8.52 | 20.43 |

| Europe | 433 | -3.75 | 1.99 | 0.62 | 12.68 |

| UK | 3951 | -4.27 | -3.04 | -2.66 | 11.44 |

| Japan | 2254 | -2.59 | 19.14 | 5.99 | 15.86 |

*LCY: Local Currency

USD Denominated Equities

| USD Denominated Equities | Sector | Current Price US$ |

Price US$ 10/31/2023 |

Dividend Yield % | 1-Year Consensus Target Price |

|---|---|---|---|---|---|

| Alphabet Inc - Class A | Communication | 138.49 | 124.08 | 0.00 | 153.29 |

| Meta Platforms Inc | Communication | 341.49 | 301.27 | 0.00 | 375.50 |

| Netflix Inc | Communication | 478.77 | 411.69 | 0.00 | 466.68 |

| Zoom Video Comm Inc | Communication | 68.38 | 59.98 | 0.00 | 79.77 |

| Amazon.com Inc | Customer Discretionary | 146.71 | 133.09 | 0.00 | 175.98 |

| Starbucks Corp | Consumer Discretionary | 103.44 | 92.24 | 2.05 | 112.35 |

| Tesla | Consumer Discretionary | 234.21 | 200.84 | 0.00 | 239.68 |

| Walmart Inc | Consumer Staples | 154.67 | 163.41 | 1.83 | 178.36 |

| Chevron Corp | Corp Energy | 144.33 | 145.73 | 4.12 | 180.02 |

| Exxon Mobil Corp | Energy | 104.01 | 105.85 | 3.50 | 104.01 105.85 3.50 126.80 |

| American Express Co | Financials | 163.79 | 146.03 | 1.42 | 174.07 |

| Goldman Sachs Group Inc | Financials | 338.64 | 303.61 | 3.03 | 376.56 |

| JPMorgan Chase & Co | Financials | 153.33 | 139.06 | 2.64 | 170.45 |

| Pfizer Inc | Health Care | 30.32 | 30.56 | 5.38 | 39.80 |

| FedEx Corp | Industrials | 256.46 | 240.10 | 1.84 | 289.42 |

| United Airlines Holdings Inc | Industrials | 39.80 | 35.01 | 0.00 | 56.67 |

| Apple Inc | Information Technology | 191.31 | 170.77 | 0.49 | 198.12 |

| Microsoft Corp | Information Technology | 377.85 | 338.11 | 0.74 | 407.63 |

| PayPal Holdings Inc | Information Technology | 56.34 | 51.80 | 0.00 | 75.15 |

| Nvidia Corp | Information Technology | 487.16 | 407.80 | 0.03 | 660.79 |

| ARM Holdings Inc | Information Technology | 61.76 | 49.29 | 0.00 | 61.54 |

| Newmont Corp | Materials | 37.69 | 37.47 | 4.25 | 49.33 |

| American Water Works Co Inc | Utilities | 130.47 | 117.65 | 2.09 |

Sources: Bloomberg, CBN, CSL Research, FCMB Asset Management Ltd., NBS, NSE

GBP Denominated Equities

| GBP Denominated Equities | Sector | Current Price £ |

Price £ 10/31/2023 |

Dividend Yield % |

1-Year Consensus Target Price |

|---|---|---|---|---|---|

| Burberry Group PLC | Consumer Discretionary | 15.18 | 16.92 | 4.14 | 19.90 |

| Ocado Group PLC | Consumer Discretionary | 5.55 | 4.65 | 0.00 | 8.38 |

| Aston Martin Lagonda Global | Consumer Discretionary | 2.31 | 2.19 | 0.00 | 3.51 |

| Barratt Developments PLC | Consumer Discretionary | 4.93 | 4.14 | 6.83 | 4.99 |

| Carnival PLC | Consumer Discretionary | 9.96 | 8.37 | 0.00 | 12.43 |

| Diageo PLC | Consumer Staples | 28.13 | 31.07 | 2.65 | 32.65 |

| British American Tobacco PLC | Consumer Staples | 25.53 | 24.54 | 8.91 | 34.00 |

| Tesco PLC | Consumer Staples | 2.78 | 2.70 | 3.92 | 3.17 |

| Coca-Cola HBC AG | Consumer Staples | 21.85 | 21.32 | 3.10 | 25.59 |

| BP PLC | Energy | 4.73 | 5.03 | 4.67 | 6.09 |

| Shell PLC | Energy | 25.73 | 26.47 | 3.83 | 31.29 |

| Seplat PLC | Energy | 1.24 | 1.28 | 7.40 | 1.66 |

| HSBC Holdings PLC | Financials | 6.09 | 5.92 | 6.93 | 7.90 |

| Lloyds Banking Group PLC | Financials | 0.42 | 0.40 | 5.96 | 0.57 |

| Barclays PLC | Financials | 1.40 | 1.32 | 5.50 | 2.02 |

| London Stock Exchange Group PLC | Financials | 89.00 | 82.80 | 1.25 | 99.46 |

| AstraZeneca PLC | Health Care | 100.94 | 102.50 | 2.33 | 128.88 |

| GlaxoSmithKline PLC | Health Care | 14.08 | 14.57 | 3.96 | 17.34 |

| Rio Tinto PLC | Materials | 55.19 | 52.55 | 5.80 | 57.94 |

| Airtel Africa PLC | Wireless Telecommunication Services | 1.12 | 1.13 | 4.00 | 1.50 |

| National Grid PLC | Utilities | 9.98 | 9.79 | 5.33 | 11.27 |

© 2025 FCMB Asset Management Limited. All right reserved.