FINANCIAL MARKETS WEEKLY

Currency Diversification via a US Dollar mutual fund: Legacy USD Bond Fund - Minimum now 1,000 units

January 20, 2022

In normal and volatile times, it is always important to maintain an investment portfolio that is diversified across currencies. We normally recommend that at least 20% of an investor’s portfolio should be in foreign currency. An investor’s objective could be to hedge against a potential devaluation of the Naira or earn real returns on investments, given limited high yielding local currency investment options. The Legacy USD Bond Fund (LBF) can assist investors to achieve both goals. The LUBF is a mutual fund, registered with the Securities and Exchange Commission, Nigeria. The Fund’s primary objective is to generate stable income over the long-term. With a minimum of US$1,209.20, investors will gain exposure to Sovereign and Corporate US Dollar Eurobonds issued by the Nigerian government and Nigerian corporates. Also, once an investment has been made, the investor can monitor the value of the investment by clicking here. Please see Product Focus below for further details.

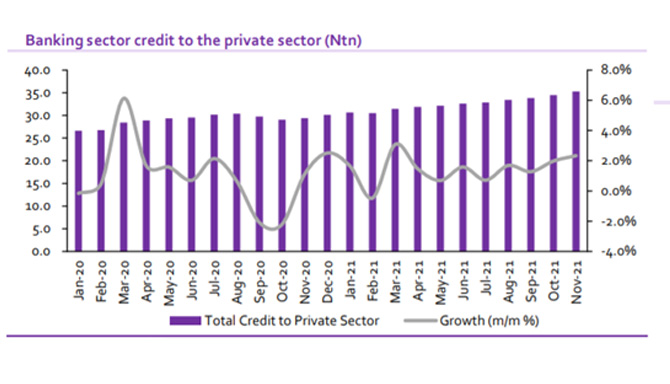

Modest expansion in private sector credit

The recent money and credit statistics by the CBN as of November 2021 showed a 2.0% m/m increased lending to the private sector, reaching another high of N35.3tn in November, from N34.5tn as of October 2021. Yearly, private sector credit was also up by 20.0% y/y from N29.4tn in November 2020. Similarly, credit to the government also improved, up 0.7% m/m to N13.0tn, from N12.9tn in October 2021.

The m/m and y/y expansion in private sector credit reflects the CBN’s continued efforts to revive the ailing economy. The CBN has been relatively successful at supporting output recovery. One, in 2021, the apex bank maintained the benchmark Monetary Policy Rate (MPR) at 11.5%, avoiding any further tightening that could stifle credit growth. While a huge proportion of the credit was towards sectors such as agriculture, oil & gas, and manufacturing, the Non-Performing Loan (NPL) ratio of Deposit Money Banks (DMBs) have remained moderate as CBN allowed banks to restructure loans to the strained sectors.

Increasing oil prices have also been supportive as many of the restructured loans to the oil and gas sector are being reported to be meeting the new terms. That said, lower yields on investment securities have forced many banks to increase lending to the real sector of the economy. In the 9 months of 2021, based on released numbers, Zenith Bank recorded a net loan growth of 8.7% relative to December 2020. Also, Access (+16.4%), UBA (+12.4%), GTCO (+4.5%), Stanbic (+31.5%), and Sterling (+13.4%) recorded a net loan growth when compared to December 2020. Looking ahead, we expect an improvement in loan growth over 2021. We forecast average loan growth of 15% for the banks under our coverage.

- FX: Last week, the Naira traded at ₦416.02/US$ from ₦415.45/US$, in the interbank market.

- Bonds:In the secondary market for Federal Government of Nigeria (FGN) bonds, yields decreased across most maturities. The yields on the 3-yr FGN bond and 30-yr FGN bond decreased by 4 basis points, (to 9.05%), and 4bps (to 13.11%), respectively. Indicative yields on US Dollar Eurobonds issued by Nigerian entities were between 2.06% and 9.64%, depending on maturity.

- Oil: The price of Brent increased by 5.27%, from the previous week’s closing price of US$81.75bbl to US$86.06bbl.

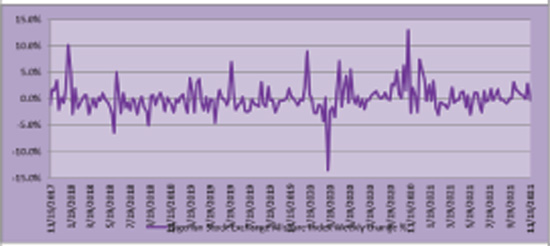

- Equities:Last week, the NSE All-Share index advanced by 1.37%. The January 2022 Year-to-date return was 4.07%. The Consumer Goods sector gained 0.87%, on average. BUA Foods increased by 24.06%, while Nestle decreased by 7.81%. For the Brewers, Guinness rose by 5.76%, while Nigerian Breweries fell by 4.17%, respectively. The Industrial Goods sector advanced by 2.43%, on average. Dangote Cement gained 8.00%, while BUA Cement lost 0.72%. The NSE Banking sector gained 0.86%, on average. Fidelity advanced by 3.59%, while GTCO declined by 2.33%. In the Agriculture sector, Presco and Okomu remained unchanged.

FCMB Asset Management Products and Services

We offer a range of products and services to our clients. These include:

- Mutual Funds

- Legacy Money Market Fund (Minimum is N1,000. Rated A+ by Agusto & Co)

- Legacy Debt Fund Rated AA- & FV3 by Agusto & Co

- Legacy Equity Fund(Winner)*

- Legacy USD Bond Fund (Winner)* (Diversify. Invest as little as US$1,208.20)

- Portfolio Management (NGN and Foreign currency)

Including for International Index Tracker Funds and stocks listed on the London Stock Exchange-

These are:

- Discretionary Mandate

- Non-discretionary Mandate

- Execution-only Mandate

- Structured Products (NGN & Foreign currency)

- Portfolio Audit

-

These are:

* BusinessDay Banking Awards 2017; NSE CEO Award 2018

Product Focus: LEGACY USD BOND FUND

Do you have concerns about a potential weakening of the Naira? If Yes, then

you should consider converting part of your Naira into US Dollars and investing

in the Legacy USD Bond Fund. The Legacy USD Bond Fund is a Securities &

Exchange Commission, Nigeria (SEC) registered US Dollar mutual fund. It is

structured as a high-yield mutual fund that seeks to generate stable income over

the long-term. The Fund invests in credit-rated US Dollar denominated fixed

income securities issued by sovereigns and corporate entities.

Legacy USD Bond Fund is listed on the Nigeria Stock Exchange. The Fund has

no currency risk, since all investments are received and made in US Dollar.

The minimum number of units an investor can purchase is 1,500, and then in

multiples of 1,000. The offer price per unit as of Thursday, 16th of December

2021 is US$1.2039 cents. Therefore, an investor will need US$1,805.85 to

purchase the minimum investment units. The minimum investment period is 6

months.

Benefits include:

- Skilled and professional fund management

- Opportunity for capital appreciation and stable income

- Excellent means of hedging against potential Naira depreciation

- Convenient way of saving towards medium-to-long term goals, including towards future foreign currency related expenditure

- Unit holders will receive monthly Investment reports

Please click here, for more information on the Fund

| Mutual Funds (December 2021) | Net Return | *Gross Return |

|---|---|---|

| Legacy Money Market Fund (90-day average) | 7.68% | 8.53% |

| Legacy Debt Fund (fund year) | 4.66% | 5.18% |

| Legacy Equity Fund (monthly return) | -0.95% | N/A |

| Legacy USD Bond Fund (fund year) | 4.69% | 5.21% |

*Yields/returns on mutual fund investments are not subject to withholding tax

| Recommended Stocks | Sector | Current Price # | 1 year target price # | Expected Change % |

|---|---|---|---|---|

| PRESCO | Agriculture | 87.8 | 110.22 | 25.5% |

| FLOUR MILLS | Consumer Goods | 28.3 | 38.88 | 37.4% |

| ACCESS | Financials | 9.75 | 12.14 | 24.5% |

| GTCO | Financials | 25.45 | 35.60 | 39.9% |

| ZENITH | Financials | 25.80 | 32.93 | 27.6% |

| LAFARGE AFRICA | Industrial Goods | 25.50 | 31.97 | 25.4% |

| MTN NIGERIA | Telecoms | 190.00 | 221.45 | 16.6% |

NSE ASI Weekly change % Since 2017

AS AT END OF DECEMBER 2021

| Country | 3-Month T-bill % | 3-year Govt Bond yield % | Headline CPI % |

|---|---|---|---|

| Nigeria | 3.1342 | 9.1500 | 15.40 |

| Kenya | 7.2710 | 10.5440 | 5.80 |

| South Africa | 3..2610 | 5.1300 | 5.50 |

| Brazil | 10.2934 | 10.6760 | 10.74 |

| Russia | 7.4010 | 9.3450 | 8.39 |

| India | 3.5900 | 5.3000 | 4.91 |

| China | 2.1550 | 2.4480 | 2.30 |

| USA | 0.0330 | 0.9488 | 6.80 |

| Germany | -0.6960 | -0.6400 | 5.20 |

| UK | 0.0400 | 0.7640 | 5.10 |

| Japan | -0.1277 | -0.0710 | 0.60 |

USD Denominated Bonds

| USD Eurobonds (Minimum 200,000 units) | Yields |

|---|---|

| Nigerian Government 5.625% Jun 2022 | 2.06% |

| Nigerian Government 6.375% Jul 2023 | 3.81% |

| Nigerian Government 7.625% Nov 2025 | 5.99% |

| Nigerian Government 6.50% Nov 2027 | 7.05% |

| Nigerian Government 6.125% Sep 2028 | 7.37% |

| Nigerian Government 7.143% Feb 2030 | 7.95% |

| Nigerian Government 8.747% Jan 2031 | 8.63% |

| Nigerian Government 7.875% Feb 2032 | 8.80% |

| Nigerian Government 7.375% Sept 2033 | 8.65% |

| Nigerian Government 7.696% Feb 2038 | 9.12% |

| Nigerian Government 7.625% Nov 2047 | 9.12% |

| Nigerian Government 9.248% Jan 2049 | 9.64% |

| Nigerian Government 8.25% Sep 2051 | 9.35% |

| Zenith Bank 7.375% May 2022 | 3.01% |

| UBA 7.75% Jun 2022 | 3.63% |

| UBA 6.75% November 2026 | 6.59% |

| Fidelity Bank 10.5% October 2022 | 5.16% |

| Fidelity Bank 7.625% October 2026 | 8.07% |

| Ecobank 9.5% April 2024 | 5.29% |

| Ecobank 9.5% Feb 2026 | 7.71% |

| Ecobank 8.75% June 2031 | 9.10% |

| FBNNL 8.625% Oct 2025 | 6.93% |

| Seplat 7.75% April 2026 | 7.67% |

| Access Bank 6.125% Sep 2026 | 6.22% |

| Access bank 9.125% Perpetual Call October 2026 | 9.61% |

| Offshore Interest Tracker Funds | Minimum |

| US Equity MSCI Index Tracker Fund | US$5,000.00 |

AS AT END OF DECEMBER 2021

| Equity Index | Closing Price | Change % in Month (LCY) | Change % Year-to-date (LCY) | Change % Year-to-date (USD) | P/E ratio |

|---|---|---|---|---|---|

| Emerging Markets | 1095 | 0.85 | -0.75 | 12.33 | |

| Developed Markets | 830 | 4.59 | 21.57 | 22.61 | |

| Nigeria | 42716 | -1.23 | 6.07 | -0.19 | 9.48 |

| Ghana | 2801 | -2.29 | 44.45 | 39.35 | 5.38 |

| Kenya | 166 | 1.56 | 9.43 | 6.01 | 11.41 |

| South Africa | 73709 | 4.59 | 24.07 | 15.97 | 12.37 |

| Brazil | 104822 | 2.85 | -11.93 | -18.71 | 6.84 |

| Russia | 3787 | -2.66 | 15.15 | 15.15 | 7.19 |

| India | 58254 | 0.00 | 0.00 | -1.71 | 27.42 |

| Hong Kong | 23398 | 0.00 | 0.00 | -0.58 | 9.35 |

| USA | 4779 | 4.64 | 27.23 | 27.23 | 26.28 |

| Europe | 488 | 5.40 | 22.29 | 15.09 | 20.76 |

| UK | 4208 | 4.52 | 14.55 | 13.48 | 20.86 |

| Japan | 1992 | 0.00 | 0.00 | -10.25 | 15.04 |

*LCY: Local Currency

USD Denominated Equities

| USD Denominated Equities | Sector | Current Price £ |

Price £ 10121912021 |

Dividend Yield % |

1-Year Consensus Target Price |

|---|---|---|---|---|---|

| Alphabet Inc Class A | Communication | 2724.57 | 2897.04 | 0.00 | 3377.89 |

| Facebook Inc | Communication | 321.98 | 336.35 | 0.00 | 399.55 |

| Netflix Inc | Communication | 511.50 | 602.44 | 0.00 | 671.21 |

| Twitter Inc | Communication | 37.18 | 43.22 | 0.00 | 61.60 |

| Zoom Video Comm Inc | Communication | 157.57 | 183.91 | 0.00 | 271.42 |

| Amazon.com Inc | Consumer Discretionary | 3,144.67 | 3,334.34 | 0.00 | 4,121.98 |

| Starbucks Corp | Consumer Disretionary | 97.74 | 116.97 | 1.88 | 121.77 |

| Tesla | Consumer Discretionary | 1,003.80 | 1,056.78 | 0.00 | 917.29 |

| Walmart Inc | Consumer Staples | 143.97 | 144.69 | 1.91 | 168.03 |

| Chevron Corp | Energy | 129.80 | 117.35 | 4.05 | 135.92 |

| Exxon Mobil Corp | Energy | 73.04 | 61.19 | 4.76 | 74.80 |

| American Express Co | Financials | 162.34 | 163.60 | 1.06 | 191.92 |

| Goldman Sachs Group Inc | Financials | 349.51 | 382.55 | 1.86 | 449.52 |

| JPMorgan Chase & Co | Financials | 150.19 | 158.35 | 2.53 | 174.04 |

| Pfizer Inc | Health Care | 54.01 | 59.05 | 2.87 | 57.74 |

| FedEx Corp | Industrials | 253.81 | 258.64 | 1.40 | 312.51 |

| United Airlines Holdings Inc. | Industrials | 44.56 | 43.78 | 0.00 | 59.05 |

| Apple Inc. | Information Technology | 167.71 | 177.57 | 0.51 | 177.69 |

| Microsoft Corp | Information Technology | 307.32 | 336.32 | 0.75 | 373.67 |

| PayPal Holdings Inc | Information Technology | 173.24 | 188.58 | 0.00 | 261.80 |

| Snowflake Inc | Information Technology | 285.31 | 338.75 | 0.00 | 392.92 |

| Newmont Corp | Materials | 63.84 | 62.02 | 3.21 | 65.58 |

| American Water Works Co Inc | Utilities | 162.50 | 188.86 | 1.42 | 171.20 |

Sources: Abokifx, Bloomberg, CBN, CSL Research, FCMB Asset Management Ltd., NBS, NSE

GBP Denominated Equities

| GBP Denominated Equities | Sector | Current Price £ |

Price £ 10/29/2021 |

Dividend Yield % |

1-Year Consensus Target Price |

|---|---|---|---|---|---|

| Burberry Group PLC | Consumer Discretionary | 18.66 | 18.18 | 2.90 | 21.24 |

| Ocado Group PLC | Consumer Discretionary | 14.54 | 16.78 | 0.00 | 21.10 |

| Aston Martin Lagonda Global | Consumer Discretionary | 12.94 | 13.53 | - | 16.96 |

| Barratt Developments PLC | Consumer Discretionary | 6.74 | 7.48 | 4.36 | 8.32 |

| Carnival PLC | Consumer Discretionary | 14.47 | 13.84 | 2.54 | 16.64 |

| Diageo PLC | Consumer Staples | 37.18 | 40.36 | 1.89 | 42.16 |

| British American Tobacco PLC | Consumer Staples | 31.34 | 27.34 | 7.04 | 35.55 |

| Tesco PLC | Consumer Staples | 2.88 | 2.90 | 3.18 | 3.24 |

| Coca-Cola HBC AG | Consumer Staples | 26.35 | 25.55 | 2.02 | 29.71 |

| BP PLC | Energy | 3.94 | 3.31 | 3.95 | 4.26 |

| Royal Dutch Shell PLC | Energy | 18.66 | 16.22 | 3.22 | 21.77 |

| HSBC Holdings PLC | Financials | 5.12 | 4.49 | 3.15 | 5.28 |

| Lloyds Banking Group PLC | Financials | 0.54 | 0.48 | 2.43 | 0.60 |

| Barclays PLC | Financials | 2.07 | 1.87 | 1.43 | 2.42 |

| London Stock Exchange Group PLC | Financials | 74.46 | 69.30 | 1.03 | 91.23 |

| AstraZeneca PLC | Health Care | 87.63 | 86.78 | 0.75 | 101.72 |

| GlaxoSmithKline PLC | Health Care | 16.72 | 16.07 | 4.78 | 16.97 |

| Rio Tinto PLC | Materials | 56.48 | 48.92 | 8.91 | 53.65 |

| National Grid PLC | Utilities | 10.89 | 10.60 | 4.53 | 10.63 |

|

Dear Client, Do you know you can set up a direct debit instruction with FCMB Asset Management in just 3 easy steps? Here is what you have to do

The Banking details of our Naira Mutual Funds are:

The benefits of using direct debit include:

|

© 2025 FCMB Asset Management Limited. All right reserved.